Artificial Intelligence (AI) at the service of financial inclusion

March 26, 2025

Diana Mejía

Jesús David Gutiérrez

We promote access to and use of high-quality financial products and services to bridge gaps in financial inclusion and education for MSMEs and underserved segments of the population in Latin America and the Caribbean. Our objective is to positively impact their financial well-being.

Ample evidence highlights the relationship between financial inclusion and:

Reducing inequality gaps

Increasing productivity

Enhancing economic well-being

Alleviating poverty

ACCESS

The extent to which new financial consumers or underserved individuals can obtain suitable financial products and services at affordable prices.

USE

The frequency and consistency of utilizing appropriate financial services.

QUALITY

The extent to which financial services meet customer needs.

FINANCIAL WELL-BEING

The ability to manage financial stability, achieve financial goals, and build savings for contingencies.

CAF mobilizes financial resources and provides technical assistance to MSMEs and underserved populations, addressing financial inclusion gaps. Beyond expanding access to financial services, CAF ensures their sustained use, quality, and relevance to the needs of MSMEs and vulnerable groups in Latin America and the Caribbean.

CAF has collaborated with over 50 regulatory and supervisory institutions, more than 45 financial institutions, and 10+ financial associations. Our efforts span regulatory and policy frameworks, financing solutions, and human capital development to meet the needs of millions of individuals and small businesses excluded from the financial system. Through strategic partnerships and initiatives, we reshape the financial landscape of Latin America and the Caribbean by designing and implementing public policies and regulations, generating and disseminating financial knowledge, promoting financial education and gender-inclusive initiatives, partnering with financial institutions to support MSMEs and developing innovative financial products.

people benefited from financial literacy initiatives

people benefited from financial inclusion projects

MSMEs benefited from financial inclusion programs

ongoing technical cooperation projects

projects with a gender focus

women benefited from gender-focused financial inclusion and literacy programs

lent to MSMEs since 2019

MSMEs financed through credit transactions

in microloans for micro-entrepreneurs

winning FinTech companies received guidance through CAF’s Financial Inclusion Laboratory

people impacted by the winners of the Financial Inclusion Laboratory.

MSMEs impacted by the winners of the Financial Inclusion Laboratory

Public policies and regulatory frameworks play a crucial role in the development of financial systems. Through technical cooperation programs and public-private partnerships, CAF seeks to contribute to the design and implementation of public policies or national strategies for financial inclusion and education, as well as regulatory frameworks that respond to Latin American and Caribbean realities, protecting users and promoting the development of new financial products.

CAF has supported more than 17 public institutions in 10 countries in the design and evaluation of policies focused on financial inclusion and education.

Featured Projects:

CAF supported SEPS -Superintendency of the Popular and Solidarity Economy- and the Superintendency of Banks of Ecuador in designing a regulatory framework that promotes the development of financial products with a gender focus, strengthens supervision of the cooperative sector, and fosters the development of SEPS's digital infrastructure.

CAF also supported SEPS in strengthening the institution's regulatory framework to implement and evaluate SEPS's financial education programs and the entities it regulates. Additionally, the aim was to analyze the institution's regulatory framework to promote ethics and good governance within the entities regulated by SEPS.

CAF provided support in the construction of Panama's financial inclusion strategy (ENIF), collaborating with the Superintendency of Banks to improve the financial education and capabilities of the population, reduce the gender gap in the ownership of financial products, and increase the use of digital financial services.

CAF supported the Central Bank of Paraguay in identifying regulatory deficiencies in capital adequacy, liquidity, and risk-weighted assets in Paraguay's financial system.

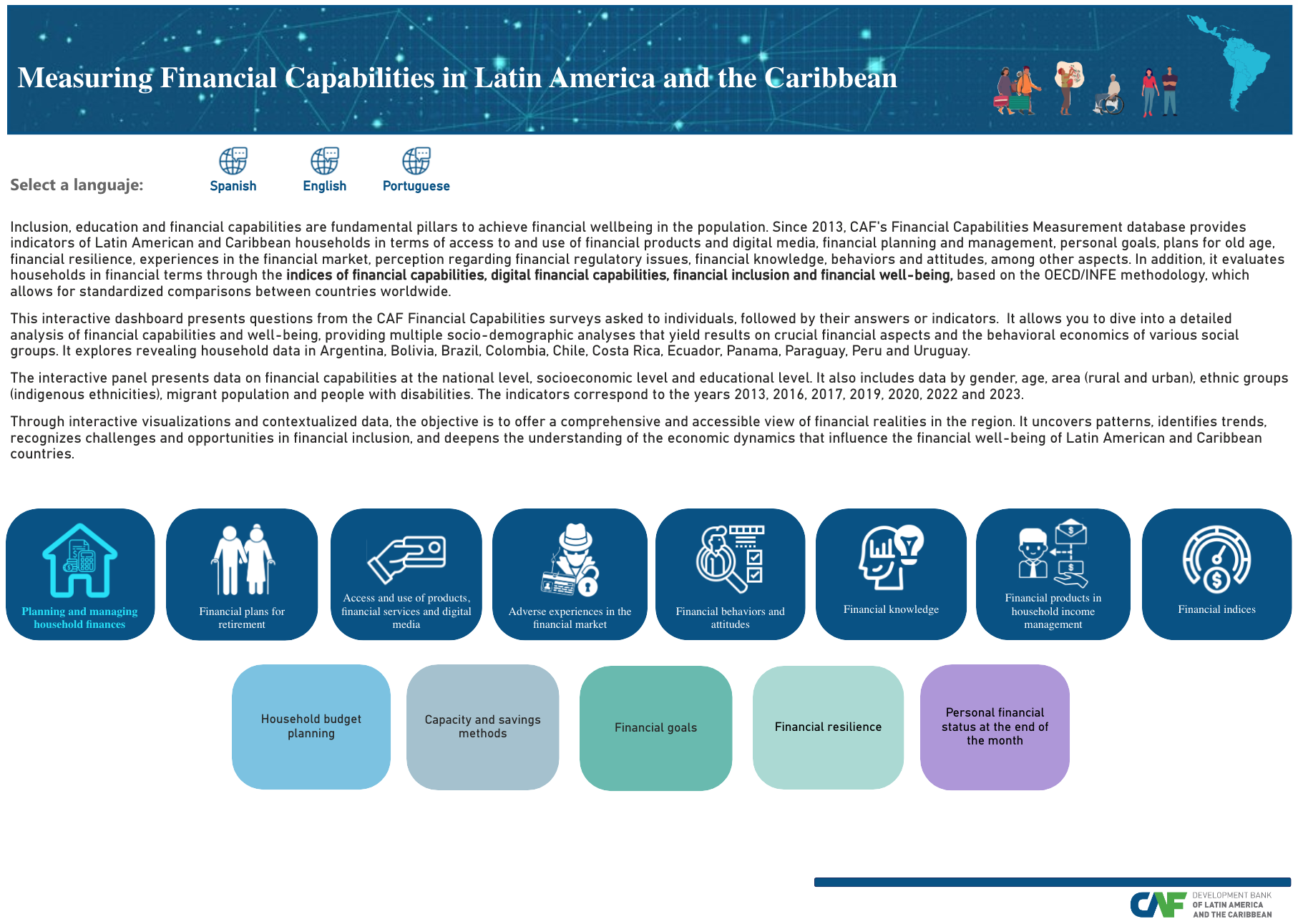

At CAF, we are committed to generating and disseminating knowledge that promotes sustainable development in the region. We have conducted the financial capabilities survey in several Latin American and Caribbean countries according to OECD/INFE guidelines, providing valuable data to understand and improve the financial education of our communities. Additionally, we conduct studies and research that are regularly published, addressing crucial topics such as financial inclusion and education, and financial well-being.

Access our interactive financial capabilities data viewer

Read our publications on financial literacy and financial inclusion

Read our blogs on financial inclusion

Discover CAF's financial inclusion playlist

Featured Projects

VISIT OUR INTERACTIVE FINANCIAL CAPABILITIES DATA VIEWER

CAF recognizes financial literacy as a key tool for economic and social development. Therefore, we implement various initiatives, such as training workshops, studies and research, collaboration with institutions, and the production of educational resources, to improve the financial capabilities of individuals and communities in the region.

.

Vulnerable Populations

Featured Projects

Closing the gaps in women's financial inclusion is a crucial part of CAF's financial inclusion strategy for the region. CAF works to reduce these gaps through financial education and the development of financial products tailored to women's needs. These actions aim to foster sustainable and equitable development in the countries of the region.

Featured Projects

The CAF Financial Inclusion Laboratory aims to support projects and initiatives that incorporate technological elements and are highly innovative. These initiatives aim to reduce the gap between the unbanked and the banked population and promote the use and quality of financial products and services.

749 fintech companies have participated in the lab.

50 winning initiatives driving financial inclusion for vulnerable populations and MSMEs.

Over 90 strategic partners across CAF member countries, including industry associations, multilateral organizations, public sector entities, banks, academia, and the tech and entrepreneurial ecosystem.

More than 14 million people have benefited from the lab's winning fintech solutions.

Over 930,000 MSMEs have gained access to financial services through the lab’s winning fintechs.

The sixth edition of the Financial Inclusion Lab (LIF 2024) focused on advancing fintech initiatives that foster financial inclusion for MSMEs and vulnerable communities across the region through artificial intelligence-driven technologies.

CAF promotes financial inclusion through innovative products such as digital microcredit, alternative credit evaluation models, inclusive savings accounts, digital payments platforms and parametric insurance. CAF also supports investments in infrastructure and FinTech projects that seek to improve connectivity and facilitate financial inclusion.

It is estimated that around 6.8 million people have benefited from the use of these products.

It is estimated that more than 7.1 million MSMEs have benefited from the use of these products.

CAF grants lines of credit to development financial institutions and private commercial banks to finance MSMEs. It also offers partial guarantees for MSMEs, sharing the risk with financial intermediaries and complementing national guarantee systems. These initiatives have a positive impact on the employment and production of MSMEs, with the objective of increasing their productivity and strengthening regional productivity.

Featured projects

March 26, 2025

Diana Mejía

Jesús David Gutiérrez

February 25, 2025

Agustín Fregossi

Rebeca Vidal

November 18, 2024

Juan Carlos Elorza

Diana Mejía