Investors

With our renewed vision of becoming the bank of economic reactivation and the green bank of Latin America and the Caribbean, in March 2022 CAF's Shareholders' Meeting approved the largest capitalization in the history of the institution, for USD 7,000 million, which will allow us to double the portfolio by 2030.

Investors

In 2024, CAF approved USD 15.856 billion, a 6.5% increase over 2023, consolidating its position as a key player in financing and promoting development in Latin America and the Caribbean.

In these operations, the support provided to the area of productive infrastructure (energy, transportation and telecommunications) stands out in a wide variety of initiatives aligned with the countries' development strategies (20% of approvals). In water and sanitation, education and urban development operations, USD 2,401 million were approved (15 % of the total), reflecting CAF's contribution to the most vulnerable sectors of the countries within the framework of the corporate strategy. In terms of operations related to macroeconomic stability and structural reforms, USD 2.93 billion were approved, which will enable CAF to support shareholder countries through budget support loans. Finally, in the productive and financial sector, USD 6.96 billion in loans and credit lines were approved for public and private companies and banks. These approvals are also aligned with the Institution's corporate strategy, framed within its mission agendas.

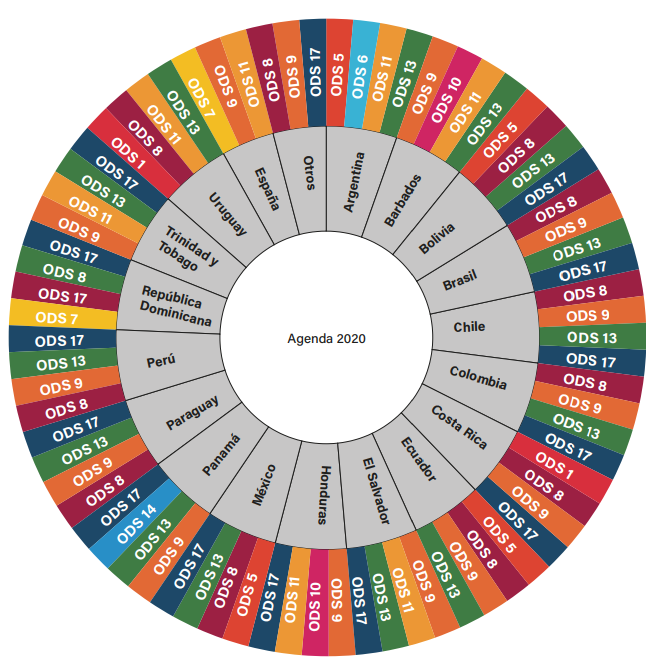

During 2024, CAF's largest contribution to the 2030 Agenda, measured by the number of operations that directly or indirectly contributed to the SDGs, is as follows:

SDG 8: Promote inclusive and sustainable economic growth, employment and decent work for all, with 97 approved operations.

SDG 17: Revitalize the Global Partnership for Sustainable Development, with 96 operations.

Main SDGs to which CAF contributes by country

Approvals

Loan portfolio

Disbursements

CAF has been present in the most demanding international capital markets for more than three decades, focused on a strategy based on broadening the investor base, improving the liquidity of its issuances, and achieving competitive funding in terms of tenor and currencies.

CAF's main capital market activities have consisted in bond issuances in the most important international markets in America, Europe, Asia, and Australia. In recent years, CAF has increased its activities in helping develop the local capital markets with issuances in shareholder countries such as Colombia, Costa Rica, Mexico, Paraguay, Panama, Peru, and Uruguay.

CAF maximizes the impact and scope of its operations through strategic alliances, which allow mobilizing resources to achieve the Sustainable Development Goals (SDGs). These alliances allow CAF to diversify its financing sources and make combined financing (Blended Finance) to enhance development initiatives and offer more favorable financial conditions to its member countries.

(in USD million)

CAF’s success accessing the international capital markets is mostly due to the high credit ratings assigned by the main international rating agencies.

These agencies have recognized the Institution's outstanding creditworthiness based on a strong capital base, which resulted from the continuous support from the shareholders through repeated increases in subscribed and paid-in capital and a greater loan portfolio diversification.

Adopting as its own the challenges outlined by the UN Sustainable Development Goals (SDG), and with the conviction that Latin American countries can make a qualitative leap towards the construction of a more inclusive, low carbon and resilient society, CAF has formulated an agenda to assist countries in the pursuit and achievement of such targets. CAF’s strategic approach focuses on mobilizing financial resources into the region to promote investments in infrastructure, energy, social development, environmental sustainability and climate change.

Given the recent changes over the last couple of years in the financial markets and in line with the recommendations given by international regulators, CAF is currently in the process of substituting the LIBOR rate.

For several decades, the London Interbank Offered Rate (LIBOR) has played a fundamental role, being the main interest reference rate for the financial markets. However, banks, authorities, and international regulators have suggested searching for alternative rates over the last couple of years.

At the 2015 Addis Ababa Conference, the importance of private investment in achieving the Sustainable Development Goals (SDGs) was highlighted, along with the key role of multilateral development banks (MDBs) in mobilizing these resources. In 2016, the MDB Methodology for Private Investment Mobilization - Reference Guide was created to standardize definitions and harmonize the measurement of private investment mobilization, bringing together several MDBs and development finance institutions (DFIs). Since then, the MDB Task Force has published the MDB Joint Report annually, presenting the private capital mobilization figures achieved by the institutions in this group. CAF – Development Bank of Latin America and the Caribbean joined this task force in 2022.

At CAF – Development Bank of Latin America and the Caribbean, we have dedicated teams focused on directing private sector investments toward projects that foster sustainable development in the region. Our commitment is to facilitate capital that drives economic growth, sustainable infrastructure, and social well-being through strategic collaborations with investors. Mobilizing these resources not only supports our initiatives but also generates transformative impact in key sectors across Latin America and the Caribbean.